Reforms to the UK’s national living wage (NLW) are expected to compound the financial and operational pressures already facing UK care homes when announced in the autumn budget. The sector is stretched by soaring costs, a fragile funding model, and intensifying regulatory demands. With care needs rising due to an ageing population and chronic health conditions, smaller operators are especially exposed to the planned NLW changes, which threaten their already limited financial flexibility.

Deputy Prime Minister Angela Rayner has tasked the Low Pay Commission (LPC) with two key objectives. The first is to eliminate the £2.00 hourly wage gap for 18- to 20-year-olds, increasing their pay by 22% from next April. In care homes, this cohort represents a material but minority share of the workforce, concentrated in entry-level care assistant and support roles. The effect will be noticeable but limited.

The second objective is to define criteria for sustainably raising the NLW for workers aged 21 and over, beyond its current benchmark of two-thirds of UK median earnings. This change carries far greater financial implications for care homes, where most staff fall into this category and earn at or near the NLW. Maintaining the current benchmark will require a 4.1% increase to £12.71 from April 2026. Any further increase risks triggering pay compression, pressuring operators to raise wages for senior staff to preserve differentials. The ripple effect multiplies total labour costs and compounds employer National Insurance Contributions (NICs), placing already-thin margins under severe strain. For many operators, even a modest uplift could push operations from marginal viability into loss-making territory. More broadly, the NIC hike has already encouraged some employers to reclassify staff as self-employed to reduce liabilities.

Source: Vacancy survey from the Office for National Statistics

Source: Vacancy survey from the Office for National Statistics

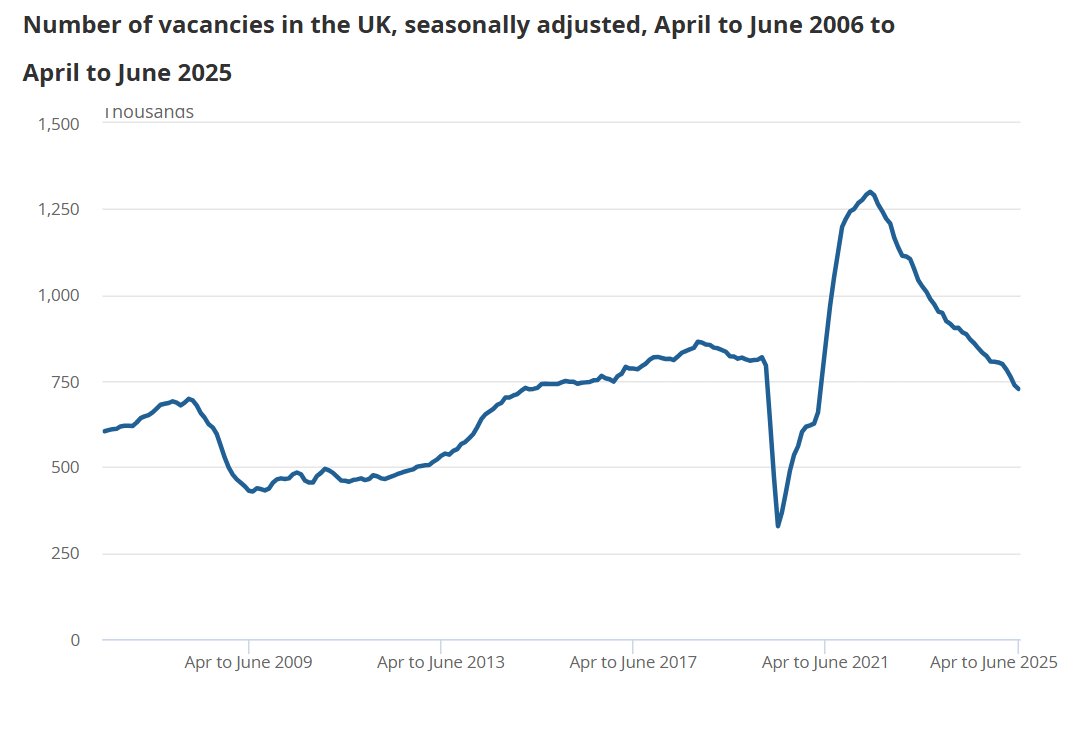

These reforms affect a sector already grappling with long-term structural headwinds, intensified by wider economic conditions. Escalating labour costs – including April’s employer NIC rise – have already forced many care homes to cut staff hours or make redundancies. A softening labour market compounds the challenge: payrolled employee numbers have fallen in seven of the past eight months, while job vacancies are at four-year lows, according to ONS data. Care work increasingly competes with other low-wage roles that offer lower stress and responsibility, making recruitment harder.

While demand for care continues to grow, local authority funding remains constrained. Many providers depend on self-funders to stay solvent, but this fragile balance limits their ability to pass on wage costs. The sector remains highly fragmented, with small and medium-sized operators often lacking the reserves to absorb shocks. Larger, better-capitalised providers may be better placed to adapt through investment and scale efficiencies.

In this context, the trade‑offs for care home operators are stark:

With few alternatives, workforce reduction is becoming the default lever for cost control – but this strategy risks undermining care quality and regulatory compliance. For small, independent homes already operating with minimal staff, even marginal cuts can significantly impact care delivery and increase regulatory risk. Against this backdrop, further NLW reform risks pushing already fragile operators beyond the point of financial sustainability, just as demographic demand makes sector capacity more critical than ever.

The LPC will submit its findings in October 2025, in time for the autumn budget. Any increase beyond the current benchmark must be carefully calibrated to avoid tipping NLW-dependent sectors like care homes into further distress.

BTG Advisory support for care home operators

Scenario planning and cost modelling can help identify operational breakpoints and test the resilience of staffing and fee structures. Early engagement with lenders, investors, and commissioning bodies is essential to preserve financial stability and sustain service levels. Operators who act early – by optimising labour deployment, implementing cost-efficiency measures, and investing in productivity – will be best positioned to manage the next phase of NLW reform.

Our diagnostic assessments help providers by identifying viable cost reductions, improving working capital efficiency, and enhancing cash flow, enabling care homes to maintain care quality while strengthening financial resilience.

Daily News Round Up

Sign up to our daily news round up and get trending industry news delivered straight to your inbox

This site uses cookies to monitor site performance and provide a mode responsive and personalised experience. You must agree to our use of certain cookies. For more information on how we use and manage cookies, please read our Privacy Policy.