Europe is embarking on an unprecedented rearmament and readiness initiative that reverses decades of underinvestment in defence. This shift is creating an attractive decade-long opportunity for private equity to invest in new niche technologies, unique capabilities, and consolidate the continent’s fragmented mid-market sector.

The historic shift in European defence spending is in response to expanding global conflicts and geopolitical tensions, as well as waning reliance on US support. These developments have prompted a strategic shift toward strengthening European military capabilities, which has spurred the political will to establish long-term, independent defence capacity.

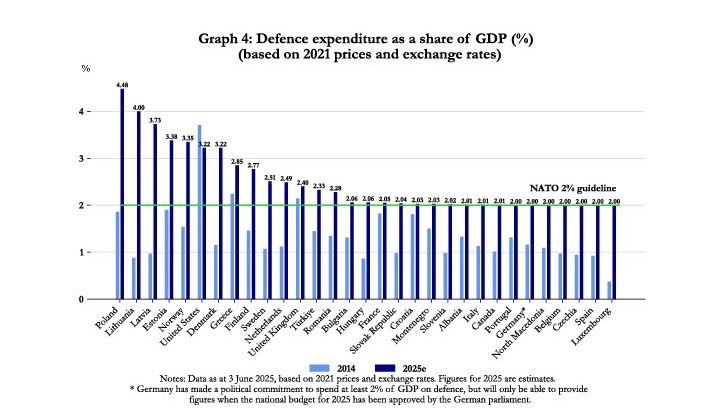

Since Russia’s invasion of Ukraine, European defence spending has surged. Average NATO defence spending is projected to reach 2.2% of GDP in 2025. According to analysis by Stockholm International Peace Research Institute (SIPRI), the leading global authority on military expenditure, European spending has increased beyond levels recorded at the end of the Cold War.

In June, NATO signalled a long-term spending pledge towards 5% of GDP for all members by 2035, with several members already committing to higher volumes. Poland already spends over 4% of GDP, Lithuania and other Baltic states exceed 3%, while Germany reformed its constitution to enable defence spending up to 3.5% of GDP by 2029. The UK has pledged to reach 2.5% of GDP by 2027 and 3% by the mid-2030s.

Figure 1: Defence spending levels strongly correlate with proximity to Ukraine

Source: NATO

Such growth on defence has driven record order backlogs for many European defence companies, boosting cash flows and investment and supporting an unprecedented valuation reset across the sector. Orders of the eight largest European defence companies increased by 15% in 2024, while their combined backlog grew by 19%, Fitch Ratings data shows, reaching a record €291 billion, up from €177 billion at the start of the Ukraine war. The defence sector will additionally receive a further boost with the proposed European Commission’s (EC) €800 billion “ReArm Europe/Readiness 2030” plan. It consists of a €150 billion loan instrument, the Security Action for Europe (SAFE), to accelerate defence investments, as well as €650 billion in national-level defence spending over the next four years.

With all the aforementioned tailwinds, for the first time in recent history, some of Europe’s prime defence contractors are trading at higher EV/EBITDA multiples than their US peers. At the same time, multiples among Europe’s fragmented defence base have increased, but not to the levels seen above, creating a compelling arbitrage opportunity for investors.

Procurement bottlenecks and the scarcity of large, prime assets are reinforcing investor focus on the vast array of SMEs and mid-caps (the £10-250m enterprise value range) as the most accessible channels to capture growth and innovation. Components manufacturing, services, and defence technologies – including dual-use areas such as drones, AI systems, cybersecurity, quantum technologies, and software-enabled systems – continue to be of high interest.

With such foundations, multiple expansions of earnings, and historic limited access to finance for defence companies, the opportunity for PE investment is compelling. The growing momentum is already evident. European defence M&A volume is expanding aggressively, with new assets consistently coming to market alongside increased liquidity.

More recently, the European Investment Fund (EIF) invested €40m in Keen Venture Partners’ European Defence & Security Tech Fund, which invests in early-stage companies in cyber defence, robotics, AI, autonomous systems and space technologies. In September, EIF also committed €30m to Sienna Hephaistos Private Investments, Europe’s first private credit fund dedicated to defence SMEs and mid-caps, supporting capacity expansion, inventory growth, and consolidation.

Dedicated vehicles are already in motion, including Tikehau’s Defence et Securite fund, designed to channel private capital into Europe’s mid-market defence sector. The focus is on sourcing European companies that can bridge the technology innovation gap with their US counterparts, support buy-and-build strategies, and scale capabilities across adjacent markets.

The broad opportunity lies in consolidating Europe’s fragmented defence SMEs and mid-caps into scaled platforms. Eventual exits could include further private equity investment, an IPO, or being acquired by one of the dominant primes. However, acquisition strategies require meticulous planning and due diligence to ensure long-term stability, operational scalability, margin accretion, and IP generation across multiple applications to mitigate volatility.

Over the next decade, investors who succeed in capitalising on these tailwinds will be those who can build scalable platforms aligned to the above. BTG Advisory’s corporate finance team is an ideal trusted adviser with defence and cross-border expertise across sourcing, structuring, regulatory approvals and closing acquisitions (M&A) at speed and scale.

If you are a private defence company or investor and would like to learn more, contact BTG Advisory’s Gunjal Patel for a confidential discussion about market opportunities and how we can support your acquisition or growth strategy.

Daily News Round Up

Sign up to our daily news round up and get trending industry news delivered straight to your inbox

This site uses cookies to monitor site performance and provide a mode responsive and personalised experience. You must agree to our use of certain cookies. For more information on how we use and manage cookies, please read our Privacy Policy.