UK SME manufacturers face converging trade, geopolitical, macro, and policy shifts that are reshaping costs, demand, pricing, and investment.

Against this backdrop, five interconnected risk factors define the market outlook for SME manufacturers. Individual companies’ ability to mitigate and capitalise on these forces will determine performance and competitiveness: (1) global trade and geopolitics; (2) access to finance; (3) cost pressures; (4) energy and input costs; and (5) company-level resilience.

For lenders, these categories inform sector appetite and borrower profiles; for private equity owners and buyers, they should feed directly into due diligence.

The EU’s new General Product Safety Regulation (GPSR), introduced in December 2024, has raised compliance, risk assessment, and quality control demands, prompting some SMEs to set up EU subsidiaries, pause expansion, or exit the market. Similar US and East Asian rules in electronics, machinery, aerospace, and medical devices are lengthening launches and raising costs, demanding greater agility and liquidity discipline from smaller exporters.

Geopolitical instability continues to distort supply chains. The Red Sea crisis has lengthened transit times and driven up freight costs, with the automotive sector highly exposed to even short delays. While direct disruption has eased – shipping rates on the Asia-Mediterranean corridor have fallen nearly 20% since mid-June, according to Freightos – longer alternative routes and network adjustments will remain until a durable political resolution is reached, sustaining higher input costs, and insurance premiums. Elsewhere, ongoing wars in Ukraine and the wider Middle East continue to unsettle global supply chains, adding to volatility in energy and commodity markets.

Larger manufacturers are better able to refinance and roll out automation, AI, and robotics to offset rising costs. By contrast, SMEs are more likely to defer investment until the autumn budget clarifies the policy outlook, tax treatment and potential policy incentives, and interest rates fall further. Markets have priced in another 50 basis points of cuts before year end. In the meantime, the gap between well-capitalised firms and the rest of the industry is widening, influencing both lender appetite and investor screening criteria. Recent PMI data fell to a five-month low of 46.2 in September, due to low new export work and a high-cost environment exacerbated by tax and labour cost rises. Suppliers connected to Jaguar Land Rover are also experiencing a temporary hit following the September cyber-attack.

Domestic and export prices are lagging rising unit costs, pressuring margins. Average manufacturing costs rose for the third consecutive quarter to July – the fastest in over two years, CBI data shows – driven by higher transportation, shipping, and supplier costs, eroding offshoring benefits. Larger firms have been quicker to offset cost pressures through automation, AI, and robotics, while many SMEs face higher upfront costs and skills shortages that slow adoption. In credit analysis, lenders place greater weight on firms’ ability to pass through cost increases, secure multi-year supply contracts, and demonstrate forward-hedging discipline to offset company-specific risks.

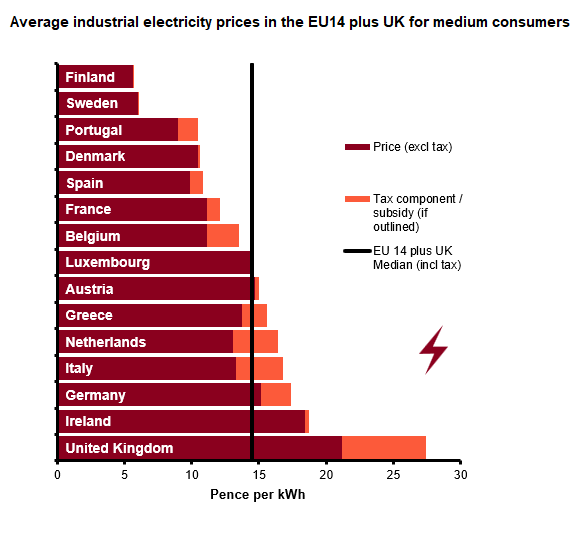

Source: Department for Energy Security and Net Zero

Raw material costs remain elevated and volatile. Commodity prices remain ~60-70% above pre-2021 levels with metals and energy prices swinging sharply on supply constraints and geopolitical events. Steel, nickel, aluminium, and copper have all experienced sharp price swings in 2025, leaving aerospace, automotive parts, and industrial machinery SMEs particularly exposed due to reliance on traded metals and global supply contracts. Such volatility complicates cash flow forecasting and debt service planning, increasing the premium placed on forward contracts, hedging discipline, and supplier diversification in credit assessments.

Lead times for high-end semiconductor chips (e.g., AI accelerators, advanced CPUs) remain extended at 30-40+ weeks, driven by capacity constraints and surging AI-related demand, while legacy chips (e.g., microcontrollers for industrial and automotive uses) have seen prices stabilise and lead times normalise to 10-14 weeks. Semiconductor dependency is now viewed as a material operational risk, with supplier diversification and proactive inventory planning key elements of SME manufacturers’ risk management strategies.

For lenders, the focus is on cash-flow visibility – how well a business can absorb input price volatility, service debt under tighter covenants, and sustain liquidity during demand or supply shocks. For private equity buyers, the priority is to identify management teams with clear cost-control roadmaps, realistic automation adoption plans, and diversified revenue streams.

While scale still matters, it is not insurmountable. SMEs that embed cost and risk discipline, invest selectively in productivity-enhancing technologies, and deepen customer relationships can position themselves as acquisition targets or consolidate share from weaker rivals.

Daily News Round Up

Sign up to our daily news round up and get trending industry news delivered straight to your inbox

This site uses cookies to monitor site performance and provide a mode responsive and personalised experience. You must agree to our use of certain cookies. For more information on how we use and manage cookies, please read our Privacy Policy.